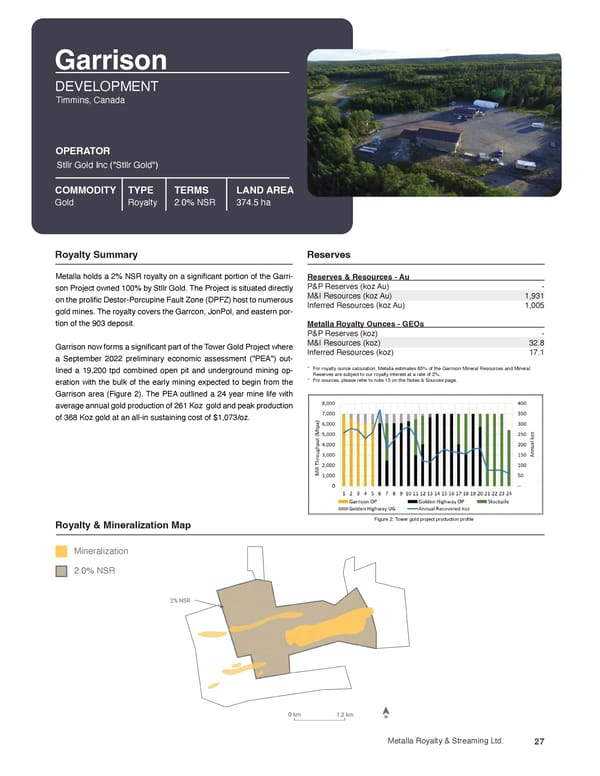

Garrison DEVELOPMENT Timmins, Canada OPERATOR Stllr Gold Inc ("Stllr Gold") COMMODITY TYPE TERMS LAND AREA Gold Royalty 2.0% NSR 374.5 ha Royalty Summary Reserves Metalla holds a 2% NSR royalty on a signi昀椀cant portion of the Garri- Reserves & Resources - Au son Project owned 100% by Stllr Gold. The Project is situated directly P&P Reserves (koz Au) - M&I Resources (koz Au) 1,931 on the proli昀椀c Destor-Porcupine Fault Zone (DPFZ) host to numerous Inferred Resources (koz Au) 1,005 gold mines. The royalty covers the Garrcon, JonPol, and eastern por- tion of the 903 deposit. Metalla Royalty Ounces - GEOs P&P Reserves (koz) - M&I Resources (koz) 32.8 Garrison now forms a signi昀椀cant part of the Tower Gold Project where Inferred Resources (koz) 17.1 a September 2022 preliminary economic assessment ("PEA") out- lined a 19,200 tpd combined open pit and underground mining op- * For royalty ounce calculation, Metalla estimates 85% of the Garrison Mineral Resources and Mineral Reserves are subject to our royalty interest at a rate of 2%. eration with the bulk of the early mining expected to begin from the * For sources, please refer to note 13 on the Notes & Sources page. Garrison area (Figure 2). The PEA outlined a 24 year mine life with average annual gold production of 261 Koz gold and peak production of 368 Koz gold at an all-in sustaining cost of $1,073/oz. Royalty & Mineralization Map Figure 2: Tower gold project production pro昀椀le Mineralization 2.0% NSR Metalla Royalty & Streaming Ltd. 27

Metalla Asset Handbook Page 26 Page 28

Metalla Asset Handbook Page 26 Page 28