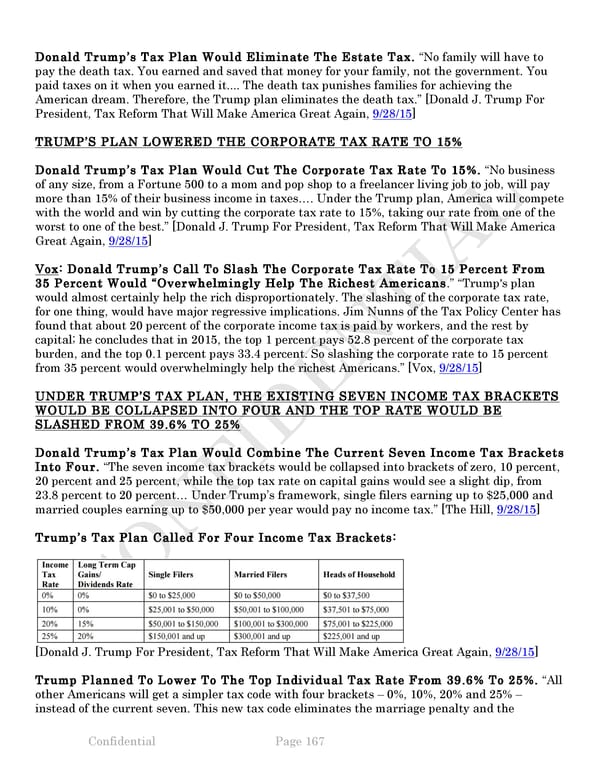

Donald Trump’s Tax Plan Would Eliminate The Estate Tax. “No family will have to pay the death tax. You earned and saved that money for your family, not the government. You paid taxes on it when you earned it.... The death tax punishes families for achieving the American dream. Therefore, the Trump plan eliminates the death tax.” [Donald J. Trump For President, Tax Reform That Will Make America Great Again, 9/28/15] TRUMP’S PLAN LOWERED THE CORPORATE TAX RATE TO 15% Donald Trump’s Tax Plan Would Cut The Corporate Tax Rate To 15%. “No business of any size, from a Fortune 500 to a mom and pop shop to a freelancer living job to job, will pay more than 15% of their business income in taxes…. Under the Trump plan, America will compete with the world and win by cutting the corporate tax rate to 15%, taking our rate from one of the worst to one of the best.” [Donald J. Trump For President, Tax Reform That Will Make America Great Again, 9/28/15] Vox: Donald Trump’s Call To Slash The Corporate Tax Rate To 15 Percent From 35 Percent Would “Overwhelmingly Help The Richest Americans.” “Trump's plan would almost certainly help the rich disproportionately. The slashing of the corporate tax rate, for one thing, would have major regressive implications. Jim Nunns of the Tax Policy Center has found that about 20 percent of the corporate income tax is paid by workers, and the rest by capital; he concludes that in 2015, the top 1 percent pays 52.8 percent of the corporate tax burden, and the top 0.1 percent pays 33.4 percent. So slashing the corporate rate to 15 percent from 35 percent would overwhelmingly help the richest Americans.” [Vox, 9/28/15] UNDER TRUMP’S TAX PLAN, THE EXISTING SEVEN INCOME TAX BRACKETS WOULD BE COLLAPSED INTO FOUR AND THE TOP RATE WOULD BE SLASHED FROM 39.6% TO 25% Donald Trump’s Tax Plan Would Combine The Current Seven Income Tax Brackets Into Four. “The seven income tax brackets would be collapsed into brackets of zero, 10 percent, 20 percent and 25 percent, while the top tax rate on capital gains would see a slight dip, from 23.8 percent to 20 percent… Under Trump’s framework, single filers earning up to $25,000 and married couples earning up to $50,000 per year would pay no income tax.” [The Hill, 9/28/15] Trump’s Tax Plan Called For Four Income Tax Brackets: [Donald J. Trump For President, Tax Reform That Will Make America Great Again, 9/28/15] Trump Planned To Lower To The Top Individual Tax Rate From 39.6% To 25%. “All other Americans will get a simpler tax code with four brackets – 0%, 10%, 20% and 25% – instead of the current seven. This new tax code eliminates the marriage penalty and the Confidential Page 167

Donald Trump Report-DNC Page 184 Page 186

Donald Trump Report-DNC Page 184 Page 186