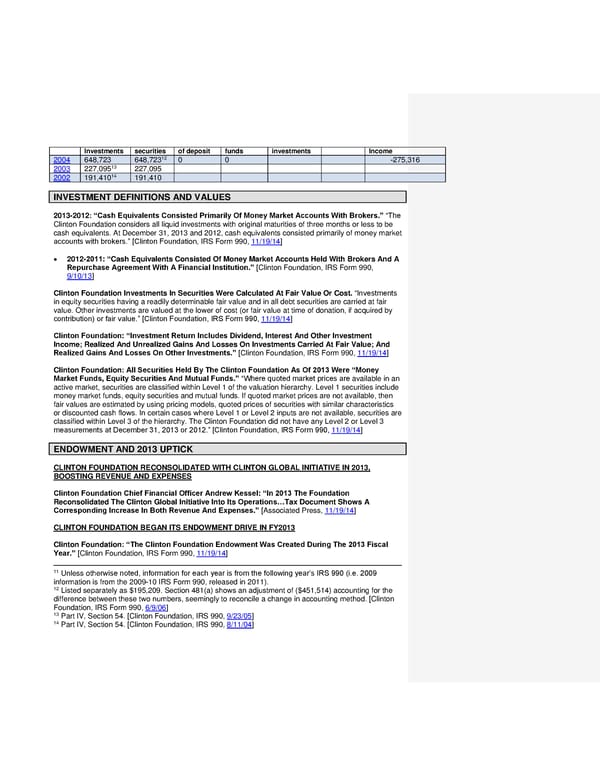

Investments securities of deposit funds investments Income 2004 648,723 648,72312 0 0 -275,316 2003 227,09513 227,095 2002 191,41014 191,410 INVESTMENT DEFINITIONS AND VALUES 2013-2012: “Cash Equivalents Consisted Primarily Of Money Market Accounts With Brokers.” “The Clinton Foundation considers all liquid investments with original maturities of three months or less to be cash equivalents. At December 31, 2013 and 2012, cash equivalents consisted primarily of money market accounts with brokers.” [Clinton Foundation, IRS Form 990, 11/19/14] 2012-2011: “Cash Equivalents Consisted Of Money Market Accounts Held With Brokers And A Repurchase Agreement With A Financial Institution.” [Clinton Foundation, IRS Form 990, 9/10/13] Clinton Foundation Investments In Securities Were Calculated At Fair Value Or Cost. “Investments in equity securities having a readily determinable fair value and in all debt securities are carried at fair value. Other investments are valued at the lower of cost (or fair value at time of donation, if acquired by contribution) or fair value.” [Clinton Foundation, IRS Form 990, 11/19/14] Clinton Foundation: “Investment Return Includes Dividend, Interest And Other Investment Income; Realized And Unrealized Gains And Losses On Investments Carried At Fair Value; And Realized Gains And Losses On Other Investments.” [Clinton Foundation, IRS Form 990, 11/19/14] Clinton Foundation: All Securities Held By The Clinton Foundation As Of 2013 Were “Money Market Funds, Equity Securities And Mutual Funds.” “Where quoted market prices are available in an active market, securities are classified within Level 1 of the valuation hierarchy. Level 1 securities include money market funds, equity securities and mutual funds. If quoted market prices are not available, then fair values are estimated by using pricing models, quoted prices of securities with similar characteristics or discounted cash flows. In certain cases where Level 1 or Level 2 inputs are not available, securities are classified within Level 3 of the hierarchy. The Clinton Foundation did not have any Level 2 or Level 3 measurements at December 31, 2013 or 2012.” [Clinton Foundation, IRS Form 990, 11/19/14] ENDOWMENT AND 2013 UPTICK CLINTON FOUNDATION RECONSOLIDATED WITH CLINTON GLOBAL INITIATIVE IN 2013, BOOSTING REVENUE AND EXPENSES Clinton Foundation Chief Financial Officer Andrew Kessel: “In 2013 The Foundation Reconsolidated The Clinton Global Initiative Into Its Operations…Tax Document Shows A Corresponding Increase In Both Revenue And Expenses.” [Associated Press, 11/19/14] CLINTON FOUNDATION BEGAN ITS ENDOWMENT DRIVE IN FY2013 Clinton Foundation: “The Clinton Foundation Endowment Was Created During The 2013 Fiscal Year.” [Clinton Foundation, IRS Form 990, 11/19/14] 11 Unless otherwise noted, information for each year is from the following year’s IRS 990 (i.e. 2009 information is from the 2009-10 IRS Form 990, released in 2011). 12 Listed separately as $195,209. Section 481(a) shows an adjustment of ($451,514) accounting for the difference between these two numbers, seemingly to reconcile a change in accounting method. [Clinton Foundation, IRS Form 990, 6/9/06] 13 Part IV, Section 54. [Clinton Foundation, IRS 990, 9/23/05] 14 Part IV, Section 54. [Clinton Foundation, IRS 990, 8/11/04]

Clinton Foundation Vulnerabilities Master Doc part 1 Page 15 Page 17

Clinton Foundation Vulnerabilities Master Doc part 1 Page 15 Page 17