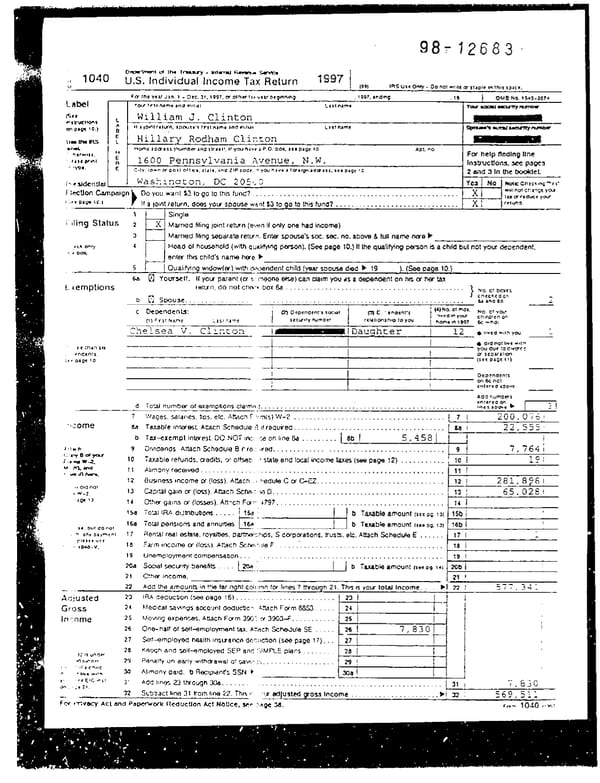

oq%nmYnt d 1tw 1-v - Mm Gevuwn cJ’vt# 1997 1 zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA 11 1040 U.S. Individual Income Tax Return zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA ’ IRS use Onfy - 00 not wfe ff S~JDIC tn rhts s3ace. Ld (991 zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA FcY the yea.’ Jan. 1 1997, ar.utng - Dec. 31. t 997, or other fry you oegtnntng . .19 ORA8 NO. 1 f&S-0074 Label You lrtt arms rnd tn~tlrl Last Nrn. YarsacwDaHtyrrrntnf E Hillary Rodham zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAClinton zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA oaub ma IRS I I i home rac~ess (number rna srrect\. If you have I P.O. box. sea PIW 10. Apt. no. r-1 For help flndlng llnc E 1600 Pennsvlvania Avenue, N.W. 4 in~tructfon~, see p3gc3 2 CI;~. town CT cost off ~0. strfe. and ZIP code. G ycu have a forergn rdcresr. fee zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAoage *C. 2 afid 3 In the boaMet c iy cs4dentJal 1 Waskinaton, DC 205X) Yes NO me: Checrrq -es* 1 EhcUon Campaign C)oyouwant~togotothisfund? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Xl WIT zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAnot chrr\~e ycu I’.>@ t zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBADave 1 C.) . _ , faxorreaue you refund. zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA I II a jornt return, does your spouse want zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA$3 to go to this fund? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . d I .I. X 1 1 Single Liing zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAStatus 2 X Manied filhg joint return (e-&n if only one had irfcome) 3 Mamed filing separate return. Entw spouse’s $0~. WC. no. above b full name here b I - bCI( only 4 I Head of household (with QuAtifying person). (See page 10.) I! the qualifying person is a child but not your deoendent. ‘- l Box enter this child’s name here ) . . - S 1 Qualifying widow@) with ckxxndent child (year spouse died ) 19 ). (See page 10.) 1.1 6a 0 zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAYowsdf. If you parent (cr s::tmeone eke) can claim you ds a dependent on his of her tax Lxemptions return, do not cboi? box &I . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Ho. cf bcxes cnec&ea on - b s Spouse................. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Q ma 6b L .., _ c lkpcndents: I cr) Oepenoenf’s socuI (3) C. -.enaent’s I (4)No. 01 mos. NO o1 yw faculty numoer reufIonsnl0 lo you 1 trvea In you cnrlaren on (l) ;rsr N&me Las1 name I 1 home tn 1997 fx wno: . . Chelsea V Cl irxon . 1 1ti-i Dauqhter ! 12 0 wea wn yau Oeosaen!s I on 6c not I I enterea a3ov-e _ ._-_ d Total number of exemotions cIa!moT . . . . . . . . . . . . . . . , . . . . . . .*. . . . . . . . . . . . . . . . . . . . . . . . . . . enterer3 on a..- lrnes abuve b s I ‘)‘Jacps, sakwes, tjps, etc. Attacn Fj~m(s) W-2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 1 200,07tSr Taxable inWest. Attach schedule ~3 rf required. ..................................... k I 22,555! b Tax-exempt interest DO NOT iw~+x on lrne $a ......... 8b ! 5,458/ 1.. I 9 Dwdends. Attach Schedule E3 ? roared ............. ........................... . . 9 * 7,764/ Taxable refunds, aedits, Y offs& ,!stateendlocalinco;netaxes(seepage 12) . . . . . . . . . . . 10 1 i,O f 11 ~Jimonyreceived............................................................. 11 I 12 8uwess Income oI (loss). Mach Mwdule c cx GF7 ................................ 12 1 281,0981 13 WMcpin w(loss ). AtfachSch~:.:~O ........................................... I 13 1 65,0281 14 Other garns o1 (IossBs). At?*.ch Fcrr 4797.. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1 II ! 1Sa To’af IF% dt;btbubom . . . . . 1 1Sa 1 b Taxable amount zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA(tee pg. I 3) .* - “se, but CO not 168 Total pmsrons and annuitks t 1fU b Taxable amount (SCO PC I 3) 1 n, my payment I? hntal real &ate, royaftk. part&~hrps. S corporations, Irusts, etc. Attach Schedule E . . . . . . clersc use 18 Farm income OT (loss). At&h Schw:~le F. . . . . .-. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ’ *’ 1040-V. Unemloment commsation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . , . . . . . 19 I Social securty Sendits . . . . 1204f1~ __i_ 1 ] b Taxable amount (SW OQ 14) ’ 20b 1 Other rncome. _ “.‘ 1 21 1 . Add the amounts in !M tar nqht CdrJfTn for lines 7 through 21. This IS yaw total Income. . . . , b t 22 I Adjusted 23 IRA oeaucbon(eapage IS)......................... 1 1 I 24 iv%dlcal Cswngs account deducW~ Mach Form 8853 . . . . . ; 1 4 Gross 24 ! I] 1 Jnwme 25 ~~~o~ng emend&. Mach Fcrm 39X cy 3903-F.. . , . . . . . . . 26 Onwhalf of self-empbyrwnt tax. zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAAt?nCh $kb&~le SE . . . . 27 sif*mp(oyed health Insurance dccucbon (see page 17). . . J: II MdN 28 Km@ and s&f-employed SEP and WWt_E plens . . . . . . . . I ‘~3 (waef 29 Penalty m sa/~y witndfawal o! 1;8~1r\~.:5. . . . . . . . . . . . . . . . . i 4 ., (1 1 cntlc I-. ’ -I lfvr WI’? 30 Alimony pald. b Recry\ant’s SSN @ Y’ L : .c EIC WI1 3: AdUIlncr,Zjthro~h30a....... . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7,630 WI. .>rZl. 32 Subtract I~ne 31 from llne ‘L2. This 1~. wr sdjusttd gou income . . . . . . . , , . . . . . . . . . . . _ . b 569,511 h, - - ..Y Fcv Wvacy Act and Puperwodc Rcductlon Act NoUct, se-p rmgc 34. FiTrh 1050 I’*:

1997 U.S. Individual Income Tax Return (B_Clinton_1997) Page 1 Page 3

1997 U.S. Individual Income Tax Return (B_Clinton_1997) Page 1 Page 3