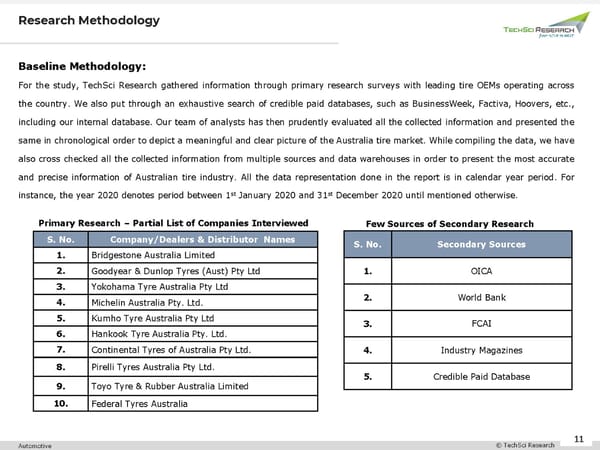

Research Methodology Baseline Methodology: For the study, TechSci Research gathered information through primary research surveys with leading tire OEMs operating across the country. We also put through an exhaustive search of credible paid databases, such as BusinessWeek, Factiva, Hoovers, etc., including our internal database. Our team of analysts has then prudently evaluated all the collected information and presented the same in chronological order to depict a meaningful and clear picture of the Australia tire market. While compiling the data, we have also cross checked all the collected information from multiple sources and data warehouses in order to present the most accurate and precise information of Australian tire industry. All the data representation done in the report is in calendar year period. For instance, the year 2020 denotes period between 1st January 2020 and 31st December 2020 until mentioned otherwise. Primary Research – Partial List of Companies Interviewed Few Sources of Secondary Research S. No. Company/Dealers & Distributor Names S. No. Secondary Sources 1. Bridgestone Australia Limited 2. Goodyear & Dunlop Tyres (Aust) Pty Ltd 1. OICA 3. Yokohama Tyre Australia Pty Ltd 4. Michelin Australia Pty. Ltd. 2. World Bank 5. Kumho Tyre Australia Pty Ltd 3. FCAI 6. Hankook Tyre Australia Pty. Ltd. 7. Continental Tyres of Australia Pty Ltd. 4. Industry Magazines 8. Pirelli Tyres Australia Pty Ltd. 5. Credible Paid Database 9. Toyo Tyre & Rubber Australia Limited 10. Federal Tyres Australia 11 Automotive © TechSci Research 11

Australia Tire Market to Reach USD 2.70 Billion by 2026 Page 10 Page 12

Australia Tire Market to Reach USD 2.70 Billion by 2026 Page 10 Page 12