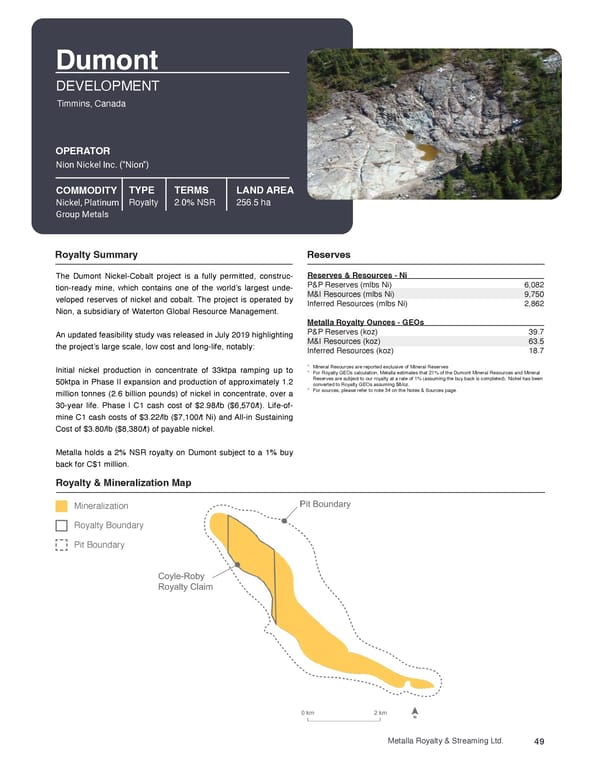

Dumont DEVELOPMENT Timmins, Canada OPERATOR Nion Nickel Inc. ("Nion") COMMODITY TYPE TERMS LAND AREA Nickel, Platinum Royalty 2.0% NSR 256.5 ha Group Metals Royalty Summary Reserves The Dumont Nickel-Cobalt project is a fully permitted, construc- Reserves & Resources - Ni tion-ready mine, which contains one of the world’s largest unde- P&P Reserves (mlbs Ni) 6,082 veloped reserves of nickel and cobalt. The project is operated by M&I Resources (mlbs Ni) 9,750 Nion, a subsidiary of Waterton Global Resource Management. Inferred Resources (mlbs Ni) 2,862 Metalla Royalty Ounces - GEOs An updated feasibility study was released in July 2019 highlighting P&P Reserves (koz) 39.7 M&I Resources (koz) 63.5 the project’s large scale, low cost and long-life, notably: Inferred Resources (koz) 18.7 Initial nickel production in concentrate of 33ktpa ramping up to * Mineral Resources are reported exclusive of Mineral Reserves * For Royalty GEOs calculation, Metalla estimates that 21% of the Dumont Mineral Resources and Mineral 50ktpa in Phase II expansion and production of approximately 1.2 Reserves are subject to our royalty at a rate of 1% (assuming the buy back is completed). Nickel has been converted to Royalty GEOs assuming $8/oz. million tonnes (2.6 billion pounds) of nickel in concentrate, over a * For sources, please refer to note 34 on the Notes & Sources page. 30-year life. Phase I C1 cash cost of $2.98/lb ($6,570/t). Life-of- mine C1 cash costs of $3.22/lb ($7,100/t Ni) and All-in Sustaining Cost of $3.80/lb ($8,380/t) of payable nickel. Metalla holds a 2% NSR royalty on Dumont subject to a 1% buy back for C$1 million. Royalty & Mineralization Map Mineralization Royalty Boundary Pit Boundary Metalla Royalty & Streaming Ltd. 49

Metalla Asset Handbook Page 48 Page 50

Metalla Asset Handbook Page 48 Page 50