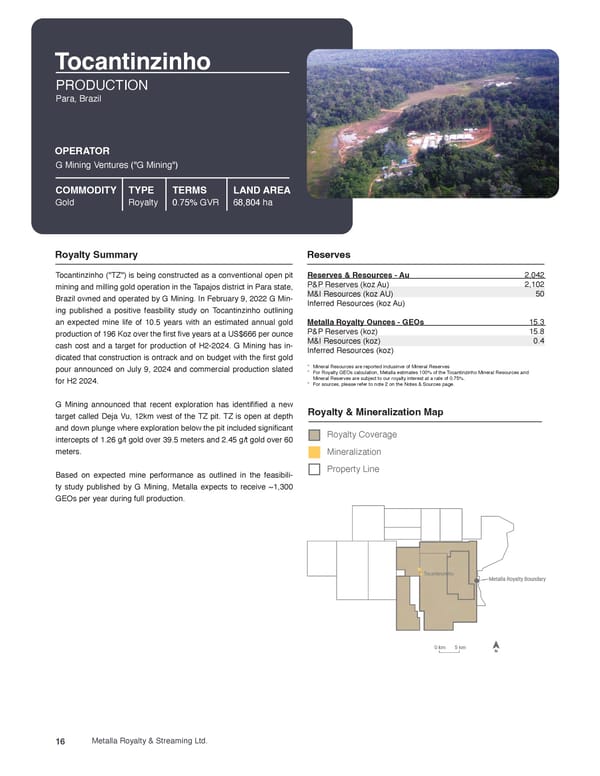

Tocantinzinho PRODUCTION Para, Brazil OPERATOR G Mining Ventures ("G Mining") COMMODITY TYPE TERMS LAND AREA Gold Royalty 0.75% GVR 68,804 ha Royalty Summary Reserves 2,042 Tocantinzinho ("TZ") is being constructed as a conventional open pit Reserves & Resources - Au mining and milling gold operation in the Tapajos district in Para state, P&P Reserves (koz Au) 2,102 Brazil owned and operated by G Mining. In February 9, 2022 G Min- M&I Resources (koz AU) 50 ing published a positive feasbility study on Tocantinzinho outlining Inferred Resources (koz Au) 15.3 an expected mine life of 10.5 years with an estimated annual gold Metalla Royalty Ounces - GEOs P&P Reserves (koz) 15.8 production of 196 Koz over the 昀椀rst 昀椀ve years at a US$666 per ounce M&I Resources (koz) 0.4 cash cost and a target for production of H2-2024. G Mining has in- Inferred Resources (koz) dicated that construction is ontrack and on budget with the 昀椀rst gold pour announced on July 9, 2024 and commercial production slated * Mineral Resources are reported inclusinve of Mineral Reserves * For Royalty GEOs calculation, Metalla estimates 100% of the Tocantinzinho Mineral Resources and for H2 2024. Mineral Reserves are subject to our royalty interest at a rate of 0.75%. * For sources, please refer to note 2 on the Notes & Sources page. G Mining announced that recent exploration has identi昀椀昀椀ed a new Royalty & Mineralization Map target called Deja Vu, 12km west of the TZ pit. TZ is open at depth and down plunge where exploration below the pit included signi昀椀cant Royalty Coverage intercepts of 1.26 g/t gold over 39.5 meters and 2.45 g/t gold over 60 meters. Mineralization Based on expected mine performance as outlined in the feasibili- Property Line ty study published by G Mining, Metalla expects to receive ~1,300 GEOs per year during full production. 16 Metalla Royalty & Streaming Ltd.

Metalla Asset Handbook Page 15 Page 17

Metalla Asset Handbook Page 15 Page 17