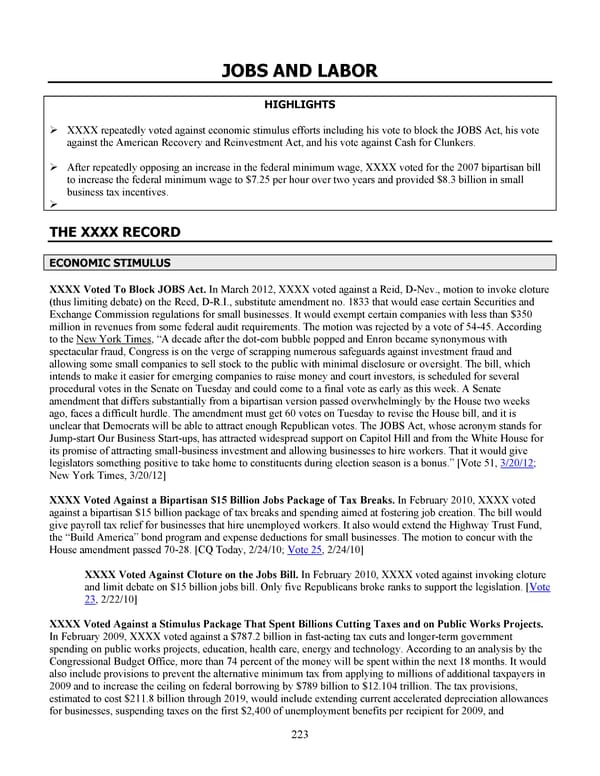

JOBS AND LABOR HIGHLIGHTS XXXX repeatedly voted against economic stimulus efforts including his vote to block the JOBS Act, his vote against the American Recovery and Reinvestment Act, and his vote against Cash for Clunkers. After repeatedly opposing an increase in the federal minimum wage, XXXX voted for the 2007 bipartisan bill to increase the federal minimum wage to $7.25 per hour over two years and provided $8.3 billion in small business tax incentives. THE XXXX RECORD ECONOMIC STIMULUS XXXX Voted To Block JOBS Act. In March 2012, XXXX voted against a Reid, D-Nev., motion to invoke cloture (thus limiting debate) on the Reed, D-R.I., substitute amendment no. 1833 that would ease certain Securities and Exchange Commission regulations for small businesses. It would exempt certain companies with less than $350 million in revenues from some federal audit requirements. The motion was rejected by a vote of 54-45. According to the New York Times, “A decade after the dot-com bubble popped and Enron became synonymous with spectacular fraud, Congress is on the verge of scrapping numerous safeguards against investment fraud and allowing some small companies to sell stock to the public with minimal disclosure or oversight. The bill, which intends to make it easier for emerging companies to raise money and court investors, is scheduled for several procedural votes in the Senate on Tuesday and could come to a final vote as early as this week. A Senate amendment that differs substantially from a bipartisan version passed overwhelmingly by the House two weeks ago, faces a difficult hurdle. The amendment must get 60 votes on Tuesday to revise the House bill, and it is unclear that Democrats will be able to attract enough Republican votes. The JOBS Act, whose acronym stands for Jump-start Our Business Start-ups, has attracted widespread support on Capitol Hill and from the White House for its promise of attracting small-business investment and allowing businesses to hire workers. That it would give legislators something positive to take home to constituents during election season is a bonus.” [Vote 51, 3/20/12; New York Times, 3/20/12] XXXX Voted Against a Bipartisan $15 Billion Jobs Package of Tax Breaks. In February 2010, XXXX voted against a bipartisan $15 billion package of tax breaks and spending aimed at fostering job creation. The bill would give payroll tax relief for businesses that hire unemployed workers. It also would extend the Highway Trust Fund, the “Build America” bond program and expense deductions for small businesses. The motion to concur with the House amendment passed 70-28. [CQ Today, 2/24/10; Vote 25, 2/24/10] XXXX Voted Against Cloture on the Jobs Bill. In February 2010, XXXX voted against invoking cloture and limit debate on $15 billion jobs bill. Only five Republicans broke ranks to support the legislation. [Vote 23, 2/22/10] XXXX Voted Against a Stimulus Package That Spent Billions Cutting Taxes and on Public Works Projects. In February 2009, XXXX voted against a $787.2 billion in fast-acting tax cuts and longer-term government spending on public works projects, education, health care, energy and technology. According to an analysis by the Congressional Budget Office, more than 74 percent of the money will be spent within the next 18 months. It would also include provisions to prevent the alternative minimum tax from applying to millions of additional taxpayers in 2009 and to increase the ceiling on federal borrowing by $789 billion to $12.104 trillion. The tax provisions, estimated to cost $211.8 billion through 2019, would include extending current accelerated depreciation allowances for businesses, suspending taxes on the first $2,400 of unemployment benefits per recipient for 2009, and 223

HRC vote skeleton Page 240 Page 242

HRC vote skeleton Page 240 Page 242