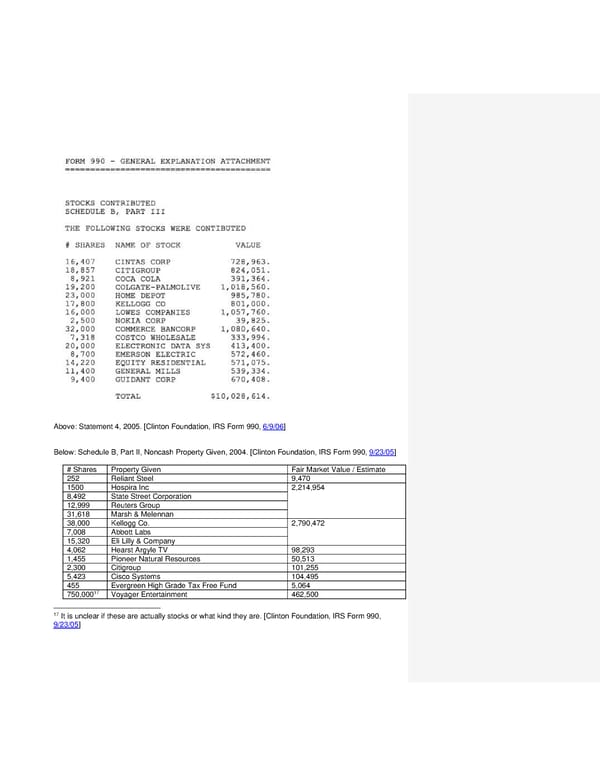

Above: Statement 4, 2005. [Clinton Foundation, IRS Form 990, 6/9/06] Below: Schedule B, Part II, Noncash Property Given, 2004. [Clinton Foundation, IRS Form 990, 9/23/05] # Shares Property Given Fair Market Value / Estimate 252 Reliant Steel 9,470 1500 Hospira Inc 2,214,954 8,492 State Street Corporation 12,999 Reuters Group 31,618 Marsh & Melennan 38,000 Kellogg Co. 2,790,472 7,008 Abbott Labs 15,320 Eli Lilly & Company 4,062 Hearst Argyle TV 98,293 1,455 Pioneer Natural Resources 50,513 2,300 Citigroup 101,255 5,423 Cisco Systems 104,495 455 Evergreen High Grade Tax Free Fund 5,064 750,00017 Voyager Entertainment 462,500 17 It is unclear if these are actually stocks or what kind they are. [Clinton Foundation, IRS Form 990, 9/23/05]

Clinton Foundation Vulnerabilities Master Doc part 1 2 Page 27 Page 29

Clinton Foundation Vulnerabilities Master Doc part 1 2 Page 27 Page 29