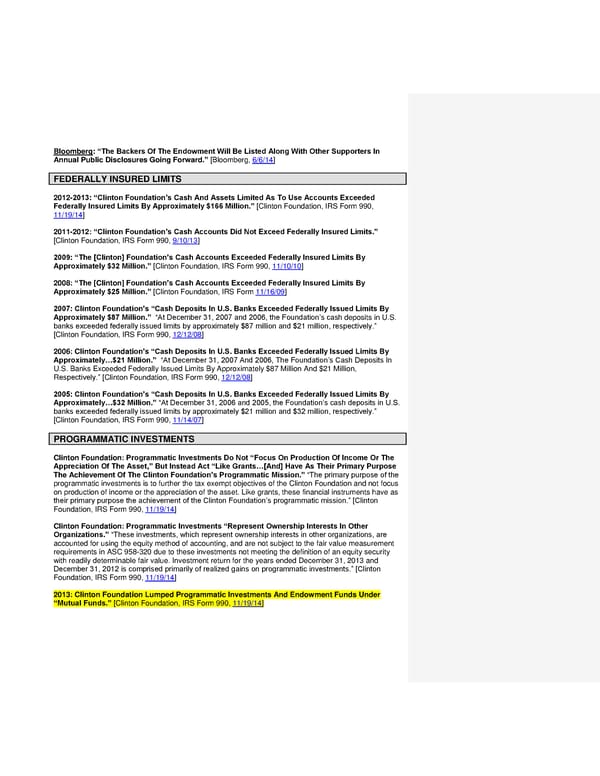

Bloomberg: “The Backers Of The Endowment Will Be Listed Along With Other Supporters In Annual Public Disclosures Going Forward.” [Bloomberg, 6/6/14] FEDERALLY INSURED LIMITS 2012-2013: “Clinton Foundation’s Cash And Assets Limited As To Use Accounts Exceeded Federally Insured Limits By Approximately $166 Million.” [Clinton Foundation, IRS Form 990, 11/19/14] 2011-2012: “Clinton Foundation’s Cash Accounts Did Not Exceed Federally Insured Limits.” [Clinton Foundation, IRS Form 990, 9/10/13] 2009: “The [Clinton] Foundation’s Cash Accounts Exceeded Federally Insured Limits By Approximately $32 Million.” [Clinton Foundation, IRS Form 990, 11/10/10] 2008: “The [Clinton] Foundation’s Cash Accounts Exceeded Federally Insured Limits By Approximately $25 Million.” [Clinton Foundation, IRS Form 11/16/09] 2007: Clinton Foundation’s “Cash Deposits In U.S. Banks Exceeded Federally Issued Limits By Approximately $87 Million.” “At December 31, 2007 and 2006, the Foundation’s cash deposits in U.S. banks exceeded federally issued limits by approximately $87 million and $21 million, respectively.” [Clinton Foundation, IRS Form 990, 12/12/08] 2006: Clinton Foundation’s “Cash Deposits In U.S. Banks Exceeded Federally Issued Limits By Approximately…$21 Million.” “At December 31, 2007 And 2006, The Foundation’s Cash Deposits In U.S. Banks Exceeded Federally Issued Limits By Approximately $87 Million And $21 Million, Respectively.” [Clinton Foundation, IRS Form 990, 12/12/08] 2005: Clinton Foundation’s “Cash Deposits In U.S. Banks Exceeded Federally Issued Limits By Approximately…$32 Million.” “At December 31, 2006 and 2005, the Foundation’s cash deposits in U.S. banks exceeded federally issued limits by approximately $21 million and $32 million, respectively.” [Clinton Foundation, IRS Form 990, 11/14/07] PROGRAMMATIC INVESTMENTS Clinton Foundation: Programmatic Investments Do Not “Focus On Production Of Income Or The Appreciation Of The Asset,” But Instead Act “Like Grants…[And] Have As Their Primary Purpose The Achievement Of The Clinton Foundation’s Programmatic Mission.” “The primary purpose of the programmatic investments is to further the tax exempt objectives of the Clinton Foundation and not focus on production of income or the appreciation of the asset. Like grants, these financial instruments have as their primary purpose the achievement of the Clinton Foundation’s programmatic mission.” [Clinton Foundation, IRS Form 990, 11/19/14] Clinton Foundation: Programmatic Investments “Represent Ownership Interests In Other Organizations.” “These investments, which represent ownership interests in other organizations, are accounted for using the equity method of accounting, and are not subject to the fair value measurement requirements in ASC 958-320 due to these investments not meeting the definition of an equity security with readily determinable fair value. Investment return for the years ended December 31, 2013 and December 31, 2012 is comprised primarily of realized gains on programmatic investments.” [Clinton Foundation, IRS Form 990, 11/19/14] 2013: Clinton Foundation Lumped Programmatic Investments And Endowment Funds Under “Mutual Funds.” [Clinton Foundation, IRS Form 990, 11/19/14]

Clinton Foundation Investments 1 Page 3 Page 5

Clinton Foundation Investments 1 Page 3 Page 5