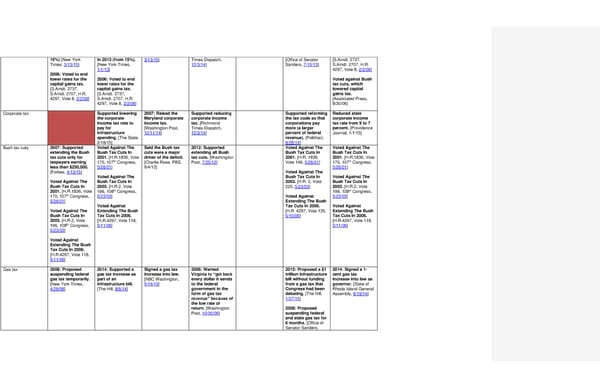

15%) [New York Times, 3/13/15] 2006: Voted to end lower rates for the capital gains tax. [S.Amdt. 2737, S.Amdt. 2707, H.R. 4297, Vote 8, 2/2/06] in 2013 (from 15%). [New York Times, 1/1/13] 2006: Voted to end lower rates for the capital gains tax. [S.Amdt. 2737, S.Amdt. 2707, H.R. 4297, Vote 8, 2/2/06] 3/13/15] Times-Dispatch, 12/3/14] [Office of Senator Sanders, 7/10/13] [S.Amdt. 2737, S.Amdt. 2707, H.R. 4297, Vote 8, 2/2/06] Voted against Bush tax cuts, which lowered capital gains tax. [Associated Press, 8/30/06] Corporate tax Supported lowering the corporate income tax rate to pay for infrastructure spending. [The State, 2/18/15] 2007: Raised the Maryland corporate income tax. [Washington Post, 10/11/14] Supported reducing corporate income tax. [Richmond Times-Dispatch, 12/3/14] Supported reforming the tax code so that corporations pay more (a larger percent of federal revenue). [Politifact, 8/28/14] Reduced state corporate income tax rate from 9 to 7 percent. [Providence Journal, 1/1/15] Bush tax cuts 2007: Supported extending the Bush tax cuts only for taxpayers earning less than $250,000. [Forbes, 4/13/15] Voted Against The Bush Tax Cuts In 2001. [H.R.1836, Vote 170, 107th Congress, 5/26/01] Voted Against The Bush Tax Cuts In 2003. [H.R.2, Vote 196, 108th Congress, 5/23/03] Voted Against Extending The Bush Tax Cuts In 2006. [H.R.4297, Vote 118, 5/11/06] Voted Against The Bush Tax Cuts In 2001. [H.R.1836, Vote 170, 107th Congress, 5/26/01] Voted Against The Bush Tax Cuts In 2003. [H.R.2, Vote 196, 108th Congress, 5/23/03] Voted Against Extending The Bush Tax Cuts In 2006. [H.R.4297, Vote 118, 5/11/06] Said the Bush tax cuts were a major driver of the deficit. [Charlie Rose, PBS, 9/4/12] 2012: Supported extending all Bush tax cuts. [Washington Post, 7/25/12] Voted Against The Bush Tax Cuts In 2001. [H.R. 1836, Vote 149, 5/26/01] Voted Against The Bush Tax Cuts In 2003. [H.R. 2, Vote 225, 5/23/03] Voted Against Extending The Bush Tax Cuts In 2006. [H.R. 4297, Vote 135, 5/10/06] Voted Against The Bush Tax Cuts In 2001. [H.R.1836, Vote 170, 107th Congress, 5/26/01] Voted Against The Bush Tax Cuts In 2003. [H.R.2, Vote 196, 108th Congress, 5/23/03] Voted Against Extending The Bush Tax Cuts In 2006. [H.R.4297, Vote 118, 5/11/06] Gas tax 2008: Proposed suspending federal gas tax temporarily. [New York Times, 4/29/08] 2014: Supported a gas tax increase as part of an infrastructure bill. [The Hill, 8/6/14] Signed a gas tax increase into law. [NBC Washington, 5/16/13] 2006: Wanted Virginia to “get back every dollar it sends to the federal government in the form of gas tax revenue” because of the low rate of return. [Washington Post, 10/30/06] 2015: Proposed a $1 trillion infrastructure bill without funding from a gas tax that Congress had been debating. [The Hill, 1/27/15] 2008: Proposed suspending federal and state gas tax for 6 months. [Office of Senator Sanders, 2014: Signed a 1-cent gas tax increase into law as governor. [State of Rhode Island General Assembly, 6/19/14]

2016 Democrats Position Cheat Sheet Page 14 Page 16

2016 Democrats Position Cheat Sheet Page 14 Page 16