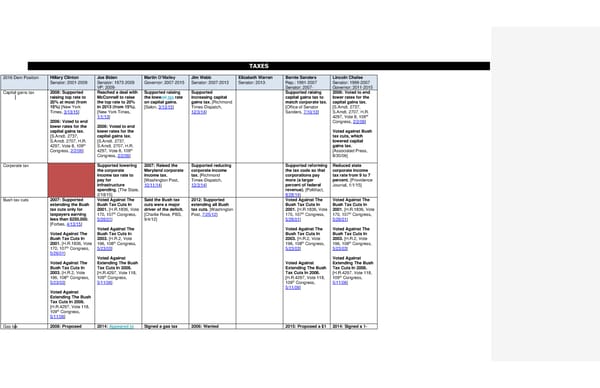

TAXES 2016 Dem Position Hillary Clinton Senator: 2001-2009 Joe Biden Senator: 1973-2009 VP: 2009- Martin O’Malley Governor: 2007-2015 Jim Webb Senator: 2007-2013 Elizabeth Warren Senator: 2013- Bernie Sanders Rep.: 1991-2007 Senator: 2007- Lincoln Chafee Senator: 1999-2007 Governor: 2011-2015 Capital gains tax 2008: Supported raising top rate to 20% at most (from 15%) [New York Times, 3/13/15] 2006: Voted to end lower rates for the capital gains tax. [S.Amdt. 2737, S.Amdt. 2707, H.R. 4297, Vote 8, 109th Congress, 2/2/06] Reached a deal with McConnell to raise the top rate to 20% in 2013 (from 15%). [New York Times, 1/1/13] 2006: Voted to end lower rates for the capital gains tax. [S.Amdt. 2737, S.Amdt. 2707, H.R. 4297, Vote 8, 109th Congress, 2/2/06] Supported raising the lowerst tax rate on capital gains. [Salon, 3/13/15] Supported increasing capital gains tax. [Richmond Times-Dispatch, 12/3/14] Supported raising capital gains tax to match corporate tax. [Office of Senator Sanders, 7/10/13] 2006: Voted to end lower rates for the capital gains tax. [S.Amdt. 2737, S.Amdt. 2707, H.R. 4297, Vote 8, 109th Congress, 2/2/06] Voted against Bush tax cuts, which lowered capital gains tax. [Associated Press, 8/30/06] Corporate tax Supported lowering the corporate income tax rate to pay for infrastructure spending. [The State, 2/18/15] 2007: Raised the Maryland corporate income tax. [Washington Post, 10/11/14] Supported reducing corporate income tax. [Richmond Times-Dispatch, 12/3/14] Supported reforming the tax code so that corporations pay more (a larger percent of federal revenue). [Politifact, 8/28/14] Reduced state corporate income tax rate from 9 to 7 percent. [Providence Journal, 1/1/15] Bush tax cuts 2007: Supported extending the Bush tax cuts only for taxpayers earning less than $250,000. [Forbes, 4/13/15] Voted Against The Bush Tax Cuts In 2001. [H.R.1836, Vote 170, 107th Congress, 5/26/01] Voted Against The Bush Tax Cuts In 2003. [H.R.2, Vote 196, 108th Congress, 5/23/03] Voted Against Extending The Bush Tax Cuts In 2006. [H.R.4297, Vote 118, 109th Congress, 5/11/06] Voted Against The Bush Tax Cuts In 2001. [H.R.1836, Vote 170, 107th Congress, 5/26/01] Voted Against The Bush Tax Cuts In 2003. [H.R.2, Vote 196, 108th Congress, 5/23/03] Voted Against Extending The Bush Tax Cuts In 2006. [H.R.4297, Vote 118, 109th Congress, 5/11/06] Said the Bush tax cuts were a major driver of the deficit. [Charlie Rose, PBS, 9/4/12] 2012: Supported extending all Bush tax cuts. [Washington Post, 7/25/12] Voted Against The Bush Tax Cuts In 2001. [H.R.1836, Vote 170, 107th Congress, 5/26/01] Voted Against The Bush Tax Cuts In 2003. [H.R.2, Vote 196, 108th Congress, 5/23/03] Voted Against Extending The Bush Tax Cuts In 2006. [H.R.4297, Vote 118, 109th Congress, 5/11/06] Voted Against The Bush Tax Cuts In 2001. [H.R.1836, Vote 170, 107th Congress, 5/26/01] Voted Against The Bush Tax Cuts In 2003. [H.R.2, Vote 196, 108th Congress, 5/23/03] Voted Against Extending The Bush Tax Cuts In 2006. [H.R.4297, Vote 118, 109th Congress, 5/11/06] Gas tax 2008: Proposed 2014: Appeared to Signed a gas tax 2006: Wanted 2015: Proposed a $1 2014: Signed a 1-

2016 Democrats Position Cheat Sheet LS edits 1 Page 15 Page 17

2016 Democrats Position Cheat Sheet LS edits 1 Page 15 Page 17