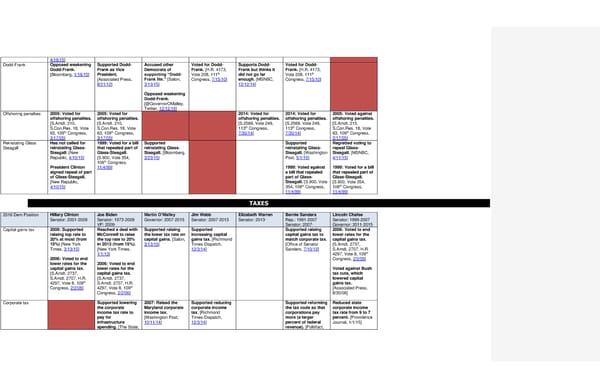

4/16/15] Dodd-Frank Opposed weakening Dodd-Frank. [Bloomberg, 1/16/15] Supported Dodd-Frank as Vice President. [Associated Press, 8/21/12] Accused other Democrats of supporting “Dodd-Frank lite.” [Salon, 3/13/15] Opposed weakening Dodd-Frank. [@GovernorOMalley, Twitter, 12/12/14] Voted for Dodd-Frank. [H.R. 4173, Vote 208, 111th Congress, 7/15/10] Supports Dodd-Frank but thinks it did not go far enough. [MSNBC, 12/12/14] Voted for Dodd-Frank. [H.R. 4173, Vote 208, 111th Congress, 7/15/10] Offshoring penalties 2005: Voted for offshoring penalties. [S.Amdt. 210, S.Con.Res. 18, Vote 63, 109th Congress, 3/17/05] 2005: Voted for offshoring penalties. [S.Amdt. 210, S.Con.Res. 18, Vote 63, 109th Congress, 3/17/05] 2014: Voted for offshoring penalties. [S.2569, Vote 249, 113th Congress, 7/30/14] 2014: Voted for offshoring penalties. [S.2569, Vote 249, 113th Congress, 7/30/14] 2005: Voted against offshoring penalties. [S.Amdt. 210, S.Con.Res. 18, Vote 63, 109th Congress, 3/17/05] Reinstating Glass Steagall Has not called for reinstating Glass-Steagall. [New Republic, 4/10/15] President Clinton signed repeal of part of Glass-Steagall. [New Republic, 4/10/15] 1999: Voted for a bill that repealed part of Glass-Steagall. [S.900, Vote 354, 106th Congress, 11/4/99] Supported reinstating Glass-Steagall. [Bloomberg, 3/23/15] Supported reinstating Glass-Steagall. [Washington Post, 5/1/15] 1999: Voted against a bill that repealed part of Glass-Steagall. [S.900, Vote 354, 106th Congress, 11/4/99] Regretted voting to repeal Glass-Steagall. [MSNBC, 4/11/15] 1999: Voted for a bill that repealed part of Glass-Steagall. [S.900, Vote 354, 106th Congress, 11/4/99] TAXES 2016 Dem Position Hillary Clinton Senator: 2001-2009 Joe Biden Senator: 1973-2009 VP: 2009- Martin O’Malley Governor: 2007-2015 Jim Webb Senator: 2007-2013 Elizabeth Warren Senator: 2013- Bernie Sanders Rep.: 1991-2007 Senator: 2007- Lincoln Chafee Senator: 1999-2007 Governor: 2011-2015 Capital gains tax 2008: Supported raising top rate to 20% at most (from 15%) [New York Times, 3/13/15] 2006: Voted to end lower rates for the capital gains tax. [S.Amdt. 2737, S.Amdt. 2707, H.R. 4297, Vote 8, 109th Congress, 2/2/06] Reached a deal with McConnell to raise the top rate to 20% in 2013 (from 15%). [New York Times, 1/1/13] 2006: Voted to end lower rates for the capital gains tax. [S.Amdt. 2737, S.Amdt. 2707, H.R. 4297, Vote 8, 109th Congress, 2/2/06] Supported raising the lower tax rate on capital gains. [Salon, 3/13/15] Supported increasing capital gains tax. [Richmond Times-Dispatch, 12/3/14] Supported raising capital gains tax to match corporate tax. [Office of Senator Sanders, 7/10/13] 2006: Voted to end lower rates for the capital gains tax. [S.Amdt. 2737, S.Amdt. 2707, H.R. 4297, Vote 8, 109th Congress, 2/2/06] Voted against Bush tax cuts, which lowered capital gains tax. [Associated Press, 8/30/06] Corporate tax Supported lowering the corporate income tax rate to pay for infrastructure spending. [The State, 2007: Raised the Maryland corporate income tax. [Washington Post, 10/11/14] Supported reducing corporate income tax. [Richmond Times-Dispatch, 12/3/14] Supported reforming the tax code so that corporations pay more (a larger percent of federal revenue). [Politifact, Reduced state corporate income tax rate from 9 to 7 percent. [Providence Journal, 1/1/15]

2016 Democrats Position Cheat Sheet FINAL Page 16 Page 18

2016 Democrats Position Cheat Sheet FINAL Page 16 Page 18