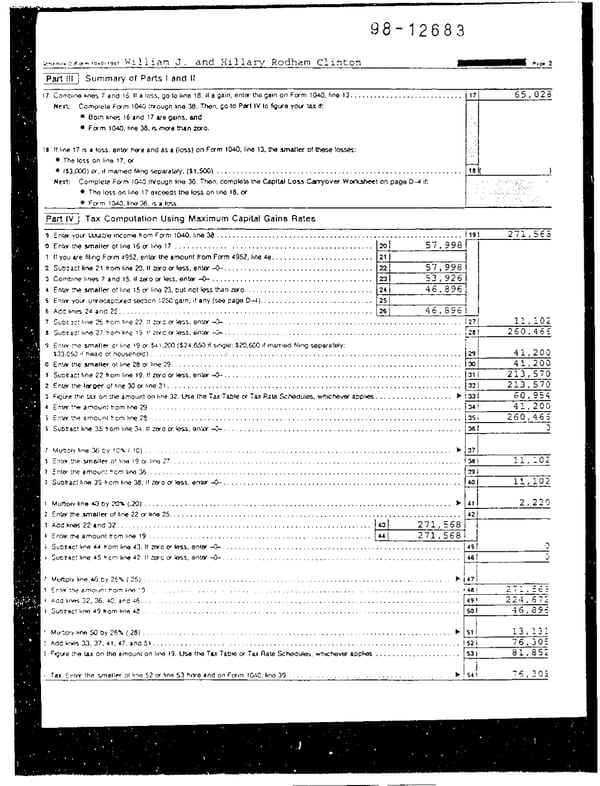

............................................................. I19 I Ent~ zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAyou taxa3le income horn Fcrm 104, line 38 En& the smaller of tlne 16 gr IIW 17 ................................................ 20 ........................ 211 1 I~youare~lingF~m~952,en~theamounttromForm~952.line~. 2 %b?aclline21 tromline2C).IfcecoorI~,enter~. .................................... 3 ~mbtnelin~7andlS.Ifzaroor~,en~~. ....................................... I 4 Entert~~allcrofI)nelS~lino23,butnotlsssVlan;r;ero ................................ 24 s Entn your unrwxotured sec~cn 1250 gain, if any (see paw 0-i). ........................... 25 f 6 Addllnes24andZE: ............................................................... Sub~3~?l~r~e~trcnltne22.Iftorc~IssS.en’~3-. .......................................................... 1271 11,102 ........................................................... 28 I 260,465 a $ubbac:llne 27 tromhne zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA19.11~~C0r~S.entEv3- 9 Entn t>e mailer of Irne 19 gr 91 .xX> (424,650 if sm@o: $x),GX rf mamed filing separatdy; $33.053 of nead of household) .............................................................................. Enterthewnalkr~~line28OrII~~. ....................................................................... Subtract line 22 from line 19. If 21~0 w kss. en&If +. .......................................................... Ente,theltqef o~llne30crline31.......................................................................~ . ............ : ...... ) Figure the tax on the amount on ltne 32. lJse the Tax Table or Tax Rate Schedules, whicheve, a@es 34. 41,200 EnWtMamoun:froml~wZ9 ............................................................................. I 1 Entrrthe amounttronlme2~ ............................................................................. Subtact line 35 tram line 34 If &‘t~o of Isis, en&~ a ........................................................... 7 MuftKAy line 36 Ly 1cx (JO) ............................................................................ ) Entcrmx.m!iJkf o!!tne 19cYllrwj 27....................................................................~ ... EfWtheamouCfrGmhw36 ............................................................................. Subtrac:line 39 trcmline38.If~oOr~.en~~ ........................................................... Mu~pry~ne40byX)%(.X)).......................................................................~ .... ) En~me~~lerofline22ocllne25 ........................................................................ Addhnes 22snd32 ............................................................... L3 271,568 Subtractline 45 fr~~11~42.11~~~00rkK~.ent~r-O- .......................................................... ~adIrr~32.~.~.a~c~b .............................................................................. AdblrrwK33.37.41.47.andSl ............................................................................ &~JW the tax on the amount on line 19. Uw the Tax Tabk or T~J Rate ~hodulos, whtchmm appbs ..................... T . 75, 305 b Tax. Entn the smaller of llnc) 52 c)r hnr) 53 hrvo and on Form lG40. /InO 39 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . , . . . . . --

1997 U.S. Individual Income Tax Return (B_Clinton_1997) Page 7 Page 9

1997 U.S. Individual Income Tax Return (B_Clinton_1997) Page 7 Page 9