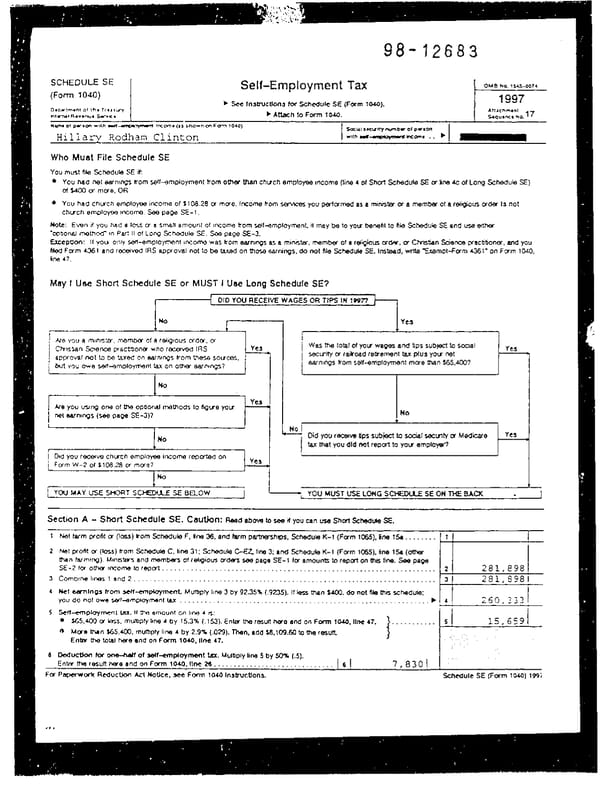

98-12683 OMB NO. l%s-ootr Self-Employment Tax zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA 1997 b See In3trucUorrs fxx Schedule SE (Form 1W). zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA ) Attach to Fwn 1040. Attxhmont 17 t-- ~qu~nce NO. H4mo of ~U8cm wtth mrl4Hpwy-M tKome (11 mown on F m 1040) Hiliary Rodham Clinton Who Must File Schedule SE You must Ma ktwdule SE it: l YOU had net wnqs from W-smployment from oUw ti chmh employee income (line 4 al Shod Schedule SE Q tine 4c of Long zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAWwdule SE) of WXI of more. OR l You had chuch emplo- incomo of SWL28 or mcfe. Income from m you pertcfm& as a minkter cx a membfx zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAof a religious order Is not chuch employs rn~ome. %a paQe s-1. &tt: Even if YOU hod a Ia cr a small amount of lncomo from self-employment. it my be to you benefit to fik Scheduk !X and us8 &her ‘0pbonaJ mathocf in Part II of Low Wwduk SE. See page Z-3. bp~: of YOU ov,ty x+empioyrwnt incomo was from sarnings as a minister, member of a rdigious or&w, 01 Chirstian sden~e practMnor. ad YOU fired Fcrm 4361 and receiw IRS approval not to be tax& on those earnings, do not file Schedule SE. Instead, write zBemot-form a361’ on Form 1040, line 47. zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA May I Use Short Schedule SE or MUST I Use Long Schedule SE? v l ------------_tDID YOU RECEIVE WAGES OR TIPS IN zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA1Wn 1 No I . YCS em-- f 1 I Aa zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAyou a rnmfs*sr, membfx of a Mgtous ofdw, cr Churn Saence practionar who recewd IRS Ye3 1 Was be total of you wages and tips subject to s&al YeS approval not to be taxed on 98.fnrngs from the56 soclrces, I scow gr railroad retkement tax plus you net but yoc owe setf-9m~loyment tax on otkr sarncngr? hi I wnlngs kom wlf-employm9nt mere than S6S,GO? h I 1 J I I L I J I t I I r YtS I ml you using one o! the optional me~ods to figue you Na net earnings (see pege SE-3)? c . ‘! -!A Ho No Did you rectawe tips subject to sodal sectnty or Medicare , yea +( I t tax that you dld not report to you employer? ( Did you roc=stw church employee income rmorted on & 1 Form W-2 of $108-28 or moro7 t YU 1 1 YOU MAY zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAUSE zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBASHORT SCHEDUX SE sa.ow CHEDUESEONTHE0ACK l 1 l---y YOU MusT USE LONG s J Section A - Short Schedule SE. Cautkm: Retid abow ta see it you cm ~38 Short Scheduk s. 1 Nat farm profit or (loss) from Schedule F, Ihe 36, and farm partnerships, Schedule K-1 (Form NE), fine ISa.. . . . . . . 1 2 ~st ptofrt O, (I-) horn Schedule C, line 31; Schedule GE2 line 3: and Schedule K-l (form 1065). Ihe 1Sa (other I I I zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBA than farming). Ministsrs and member UI rehgious orders ~88 page SE-l for amounts to repat on this line. & page SE-2foro~incometor~ort.....................................,.....,.,...................... 3 f.kmbtne1w6 land2....................................,..,.....,......,.,..,......,,......... 4 Met aanlnp from ~-~mpcoYmef?C Muttipty line 3 by 9235% (.9235). If less than $400, do not file this scheduka: you do not owe self-emp@yment tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . , . . . . . . . . . . . . b 5 !%f-empcOyrnef7ttax.Ifth amount on line 4 6: . %5,400 o, ks, mUbpty lrne 4 by 15.3% (. 153). Enter Uw mutt hero and on Form 1040, llne 47. . . . . . . . . . . . 0 Mom than StS,GXl, mutipIy lha 4 by 2.9% (.029). Then, add WJO9.60 to the resuk Enter the total We and on Form 1010, llne 47. 6 Deductlorrtu~ of sdf-emp(oymmt taX. Multiply line S by 5096 (.S). . . Entnt?wmufthemando~Fom loIo,tlnt26 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 1 For Paperwork Rcductba Act NoUce, 3ec Form lo(o InstructIons.

1997 U.S. Individual Income Tax Return (B_Clinton_1997) Page 10

1997 U.S. Individual Income Tax Return (B_Clinton_1997) Page 10