1996 U.S. Individual Income Tax Return (B_Clinton_1996)

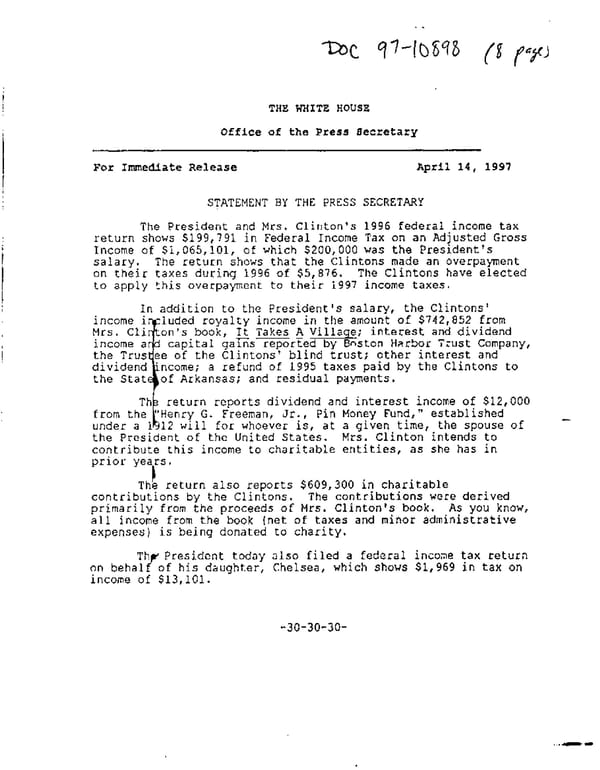

THE WHITE HOUSE Office of the zyxwvutsrqponmlkjihgfedcbaZYXWVUTSRQPONMLKJIHGFEDCBAPress Secretary For Immediate Release April 14, 1997 STATEMENT BY THE PRESS SECRETARY The President and Mrs. Clinton’s 1996 federal income tax return shows $199,791 in Federal Income Tax on an Adjusted Gross Income of $i,O65,101, of which $200,000 was the President’s salary. The return shows that the Clintons made an overpayment on their taxes during 1996 of $5,876. The Clintons have elected to apply this overpayment to their i997 income taxes. In addition to the President’s salary, the Clintons’ income i luded royalty income in the amount of $742,852 from Mrs. Cli on’s book, It Takes A Village; interest and dividend - - income a capital gains reported by Boston Harbor Trust Company, the Trus ee of the Clintons’ blind trust; other interest and dividend ’ ncome; a refund of 1995 taxes paid by the Clintons to the Stat of Arkansas; and residual payments. Th return reports dividend and interest income of $12,000 from the “Henry G. Freeman, Jr., Pin Money Fund,” established - under a i 1 12 will for whoever is, at a given time, the spouse of the President of the United States. Mrs. Clinton intends to contribute this income to charitable entities, as she has in prior years. 1 The return also reports $609,300 in charitable contributions by the Clintons. The contributions were derived primarily from the proceeds of Mrs. Clinton’s book. As you know, all income from the book (net of taxes and minor administrative expenses) is being donated to charity. Th President today also filed a federal income tax return on behal ? of his daughter, Chelsea, which shows $1,969 in tax on income of $13,101. -3o-30.30.

1996 U.S. Individual Income Tax Return (B_Clinton_1996) Page 2

1996 U.S. Individual Income Tax Return (B_Clinton_1996) Page 2